Travel Insurance FAQ

When business travel doesn’t go to plan, Travel Insurance are there to help to cover out-of-pocket costs to your business and employees.

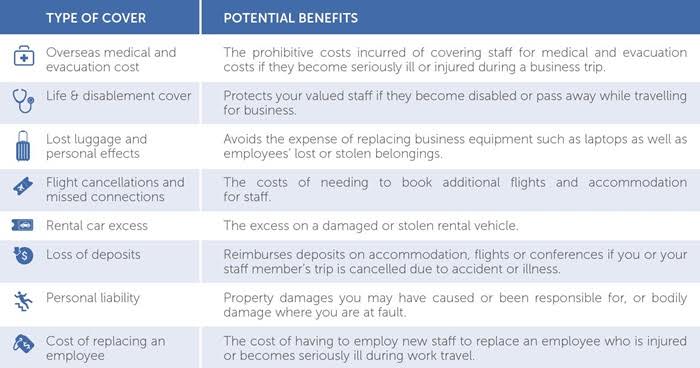

If you or your employees need to travel for work, Travel Insurance can protect your business from financial loss associated with situations such as overseas health emergencies, flight cancellations or lost and stolen baggage.

Travel Insurance is similar to personal travel insurance. It can cover your business for unanticipated travel costs if specific events happen.

Travel Insurance also covers your directors and employees, and spouses and dependents travelling with them.

Travel Insurance policies offer businesses a cost-effective, annual corporate travel policy.

Key Policy Benefits

Age limit increased to 100 years

No exclusion for financial collapse of an entity under Cancellation, Curtailment and Loss of Deposits o Additional expenses cover included for domestic travel.

Death by specified sickness covered for $50,000 including heart attack, cardiac arrest, pulmonary embolism, stroke, malaria and dengue fever.

A Journey includes private travel interstate and overseas for Company Directors, Chief Executive Officers, Chief Financial Officers/Controllers, General

Managers, Senior Managers, and Company Secretaries of the insured including any accompanying spouse/partner and dependant children

Cover for loss of reward points included under Cancellation, Curtailment and Loss of Deposits

Our Hire Car Excess section includes the cost of the return of a hire car and own car cover when on a journey

No Terrorism Exclusion and a limited war exclusion

Claims Example

Background

The Director of the popular restaurant group booked a family holiday to Bali several months in advance. Three days before the family were due to leave for their holiday, an ash cloud in Bali grounded all flights and the Director and their family were unable to go to Bali.

Outcome

The insurer reimbursed the Director for all deposits paid in advance. The Director was unable to secure flight refunds from their airline.